- HELPFUL TRADER

- Posts

- Helpful trader 06/19

Helpful trader 06/19

Last week I found myself trading with very consistent and good results, been hopping on higher timeframe forex trades and found it very accurate and very good, small losses 2x-3x wins high win rate.

Lets try and make a banger post today

Let me give you a lesson for today.

Noise

Looking at this chart it is looking likely that the market will sell. However noise in here often is what kills a good trader.

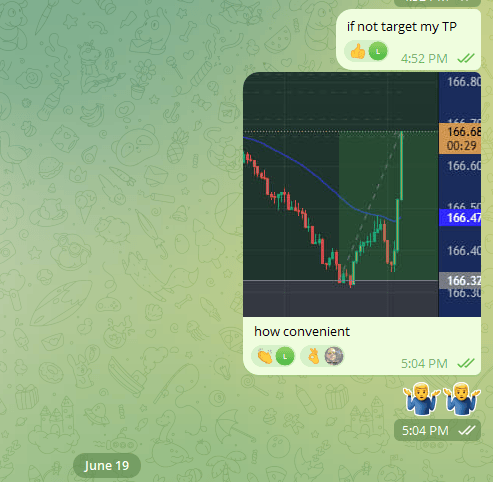

But on 4hr this was the trade I sent out to my signal group

Clearing up the noise is much more important in trading and those who follow me know that high winrate, but less trades is what makes you end month in 10% to 20% profit.

Psychology

When I tell guys to hold trades it is always same response I am getting

“It takes too long to hit tp”

“It makes my psychology want to close”

“I am scared of losing”

All of the above are due to people lacking experience in trading or not trusting trading plan/process enough.

I know at least 10 people in that last month that came to me and explained their situations… Currently they are trading way above their means. Making few hundred dollars from job, but taking risks of same equivalent amount in one trade. And that trade is small SL one.. Does that make sense? Might as well go for casino…

⬆️This is how many traders seem to me⬆️

So let me just share my own thinking. I do think every now and then of when things changed for the better, when did it go from being bad to being very good..

The most important lesson. Ditch the shiny object systems!

No more ICT!

No more SMC!

No more SND!

No more..!

Your bank account is like this old lady, at the end of its last breath and you still want to suffocate it by trading garbage concepts/systems.. It is not meant to insult you though. I hope you will think to yourself and try to understand that you can do better!

Question of “Why am I not profitable?” often gets met with I am missing something. Is this you?

Yes you are missing reality check. Only understanding how this industry works can set you free. It isn’t easy path forward. You might think it is, because you learned this. However you will go back to suffocating your bank account and blaming it on psychology or missing something, looking for something new.

Mistaking psychology for searching shortcuts, instead of learning real trading.

Fundamentals

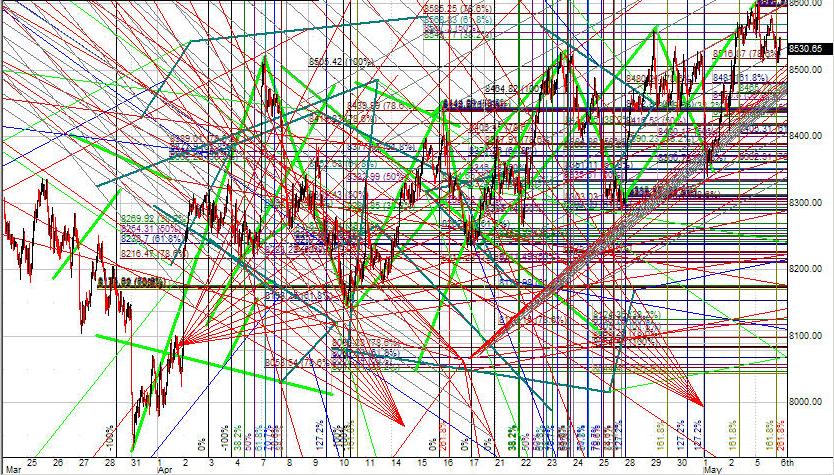

Does your trading look like this?

Of course I am exaggerating, but think about it.

If you want to be artist and draw you can do this.

Perfect art “laundering money”

Why do hedge funds hire people with economical background? To simply know where market is going…

There isn’t just 1 algorithm running the market. There are hundreds of big money algorithms running trading. No, orderblocks won’t only work. No, fair value gaps won’t only work. Can it be substitute to enter market? Possibly. But any experienced trader will tell you that reading price from the left is a sign that person cannot trade!

Tools like Mrktedge.ai are super important, with live data feed of news events or even if you are new to trading and have hard time determining BIAS. It solves every issue there is! Helps you with direction, helps you with sentiment and best even gives you areas of calculated technicals. All in one tool for as little as 45$ a month, only one tool that is marketed on similar level is Prime market terminal and it is way worse and overpriced costing at 159$ a month. A whopping 3.5 times higher price, for same tools.

With code: Helpfultrader you will get 10% discount this will be a game changer for your trading journey!

Fundamentals are what profitable traders say makes 80% of trading idea! Now if you don’t use them, start trading like a professional and learn something that is real and works. Remember the old lady looking for shiny object, well this is not shiny object that is instant solution, but it is the only real edge that retailer has!

Observational behaviour

This isn’t being taught at all, but for me it is the biggest game changer in terms of going from bad to good results.

What is observational behaviour? It is simply a way to approach market through lens of not caring about outcome and passively being able to monitor market without creating Bias or shifting Bias.

The way I do it is. I make analysis of pair that will be worth observing (might be multiple pairs). Then you research current market sentiment, upcoming news and key areas.

Then what? You wait observe the market, but don’t jump in unless your trading criteria are met! One could say it is trading system? Not at all, systematic trading or a trading system is a fancy way to say I am not adapting to markets or I don’t know how to adapt to markets. This shows inexperience and lack of understanding about real trading.

There are no shortcuts and if you are taking shortcuts, well be prepare to get back to your bank account being drained over and over again.

So to summarize this and make it simple. More important than trading system or specific way you execute is being able to observe market without having bias in mind and ability to adapt. “Trump says Iran and US going to war”. And I was seeing risk on yesterday, well now it shifts to risk off Nasdaq sells off, Gold goes up! Tariffs gets reintroduced? Okay I am shifting.

I took trade it is running in profit and market sentiment shifts? I am closing in less profit then desired TP!

There is way more to learn about trading than just drawing lines and I am giving you so much information in here about the treasure chest that I collected throughout my years of trading!

These days I am not feeling anymore drive towards writing newsletter everyday. It sort of feels like chore, where I am getting 0 rewards. But today was the day where I felt different and decided to give a nice little update as well as giving you guys a chance to work more closely with me through my signal channel. I am looking to change lives of few people in there and if you want to join that journey be my guest.

Last week I managed to make 5%, this week currently position floating with 1.5% in profit. This is the perfect approach for prop firms and we are looking to scale people to 100k accounts. However I would appreciate if you don’t use my signals on Robs prop firm, since we are already looking for seasoned traders there that are profitable and not just copying me!

Future of newsletter?

I am thinking of making future of newsletter free towards weekly analysis and few of those days per week paid version, where I would at least reap some benefits from running it. Now It won’t be the same as before, I think that model is boring and not helpful enough, however I will start focusing more on giving swing trading tips and not just “Scalp to that target my friend” ideas.

I know the crowd in here aren’t only serious people, but some are actually very serious people. I would love to weed out those who aren’t as serious and leave them with weekly expectations, whereas those who are serious about learning. I want to give real edge, using great tools, generating ideas and starting to learn real stuff.

Reply